Predictable Growth Across the Insurance Lifecycle

Align policy management, claims processing, agent workflows, and customer engagement within a unified platform designed for speed, visibility, and regulatory control.

The Operational Reality

Insurance companies run on powerful core systems — underwriting, claims, billing, and compliance. Yet despite this strength, most face the same structural challenge.

Engagement & Acquisition

Marketing campaigns, agent outreach, and digital channels generate leads. Customer records remain incomplete and disconnected.

Policy Issuance

Policies are issued through multiple systems. Customer data becomes fragmented across billing and service platforms.

Onboarding & Activation

Customers begin their coverage journey. Records and interactions remain siloed across departments.

Claims & Service Interactions

Claims and service requests generate valuable behavioral signals. Visibility into full customer context is limited.

Billing & Payments

Premium collection involves multiple touchpoints. Payment data is disconnected from service and engagement activity.

Renewal & Expansion

Retention and upsell depend on lifecycle signals. Without unified visibility, revenue becomes reactive.

The Missing Architecture

Insurance runs on strong core systems. But as products, channels, and customer expectations expand, fragmentation grows.Without a unified data and orchestration layer, insurers cannot manage the full customer lifecycle intelligently.

What It Takes to Build Intelligent Insurance Operations

Insurance doesn’t break because of tools. It breaks when policy, claims, billing, and distribution operate in silos.

Intelligent insurance operations require a unified lifecycle — where customer, policy, risk, and revenue data move together.

Why CloudOffix?

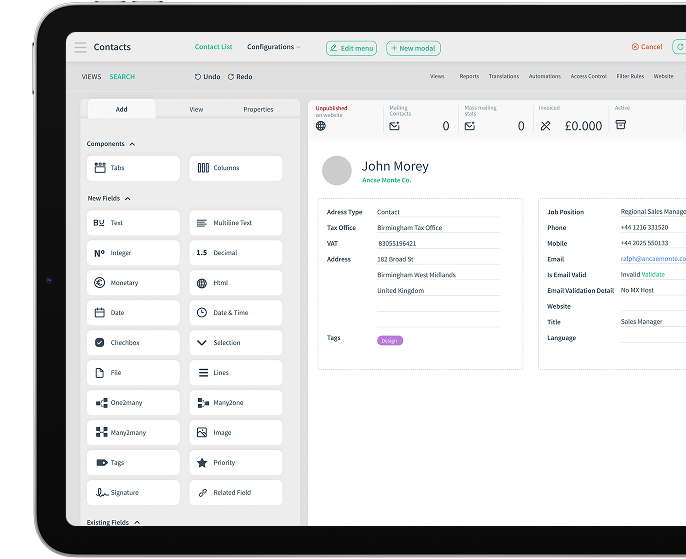

CloudOffix connects the insurance lifecycle — without replacing the core.

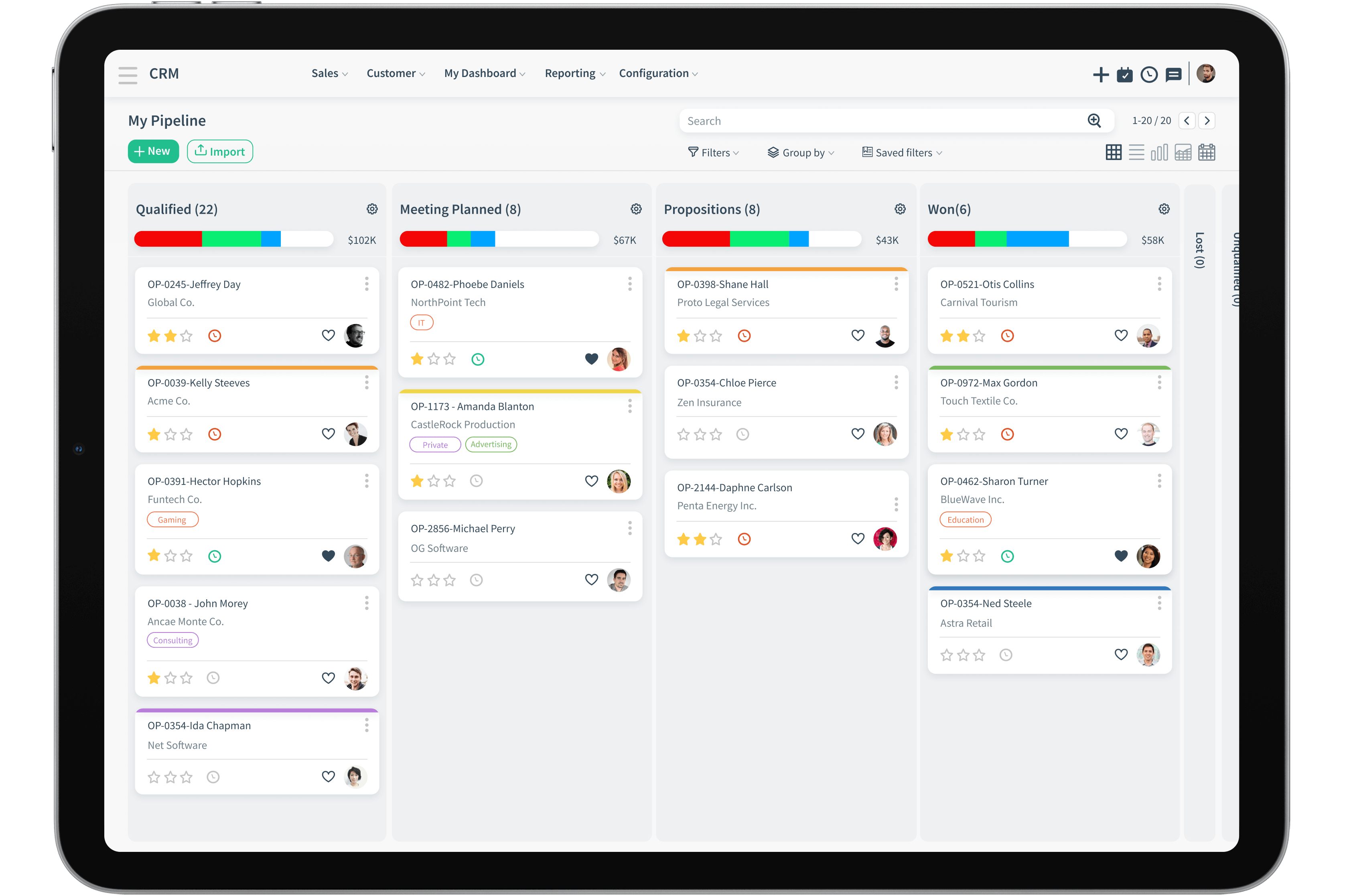

Capture Every Prospect in a Single Record

Prospects arrive through agents, digital channels, or campaigns

CloudOffix creates a single structured record that eliminates duplicate data before policy creation.

Policy Data Stays Fully Connected

Policies are issued in core systems.CloudOffix synchronizes policy data across claims, billing, and service, preventing data silos.

Onboarding Without Context Loss

New policyholders are onboarded in one connected environment.

All teams work on the same customer record from day one.

Coverage Stays Visible

Premiums, payments, and risk signals stay unified in one workspace. Customer health remains visible in real time.

Service and Claims, Fully Aligned

Claims and service interactions generate continuous insight. Teams access full policy context and history without switching systems.

Growth Opportunities Surface Automatically

Cross-sell and upsell opportunities appear automatically. Growth is driven by unified policy intelligence.

Renewals Become Proactive

Renewals are driven proactively by behavior, risk, and engagement signals. Retention becomes data-driven, not reactive.

Business Impact

Increase Renewal Predictability & Retention

Detect churn signals early and act before renewal risk grows. Shift from reactive follow-ups to data-driven retention.

Improve Claims & Service Efficiency

Accelerate claims resolution and service coordination. Empower teams with complete policy and interaction visibility.

Enhance Premium & Billing Accuracy

Connect policy, endorsements, and billing in one flow. Reduce revenue leakage and manual corrections.

Optimize Customer Lifetime Value

Use unified lifecycle data to drive cross-sell and upsell. Turn policyholders into long-term value.

Eliminate Revenue & Data Leakage

Prevent missed renewals, delayed endorsements, and billing gaps. Ensure every lifecycle event is reflected across systems.

Scale Without Operational Complexity

Grow products and channels without adding chaos. Maintain strategic control as the business scales.

AI That Understands Insurance

Isolated AI automates tasks. Unified AI reshapes insurance. CloudOffix connects policy, claims, billing, and renewal into one predictive revenue engine.

Build AI Around Your Insurance Operations

Why force generic AI tools into complex insurance workflows when you can build AI around underwriting, claims, policy lifecycle, and risk management?

Want to Increase Retention, Reduce Risk, and Accelerate Growth?

Unify customer, policy, claims, and risk data — and act before the market moves. • Detect churn before renewal • Recommend coverage based on real risk • Optimize renewals with behavioral insight • Automate execution across the lifecycle Predictable revenue. Intentional growth. No guesswork.