When it comes to providing service, customer experience strategy is the most valuable asset for companies. The banking industry has experienced the benefits of creating a positive customer experience for a long time in the business world.

It’s not just a matter of providing services to customers, but of providing the best possible customer experience. Customer experience strategy is the key to success in any business. A good customer experience strategy is vital for the banking industry. Banks offer a wide range of services to customers and businesses, including loans, credit cards, and checking accounts.

The banking industry has rapidly changed and invested in its customer experience cx process. The competition is high in this context. Adapting to change in a competitive business environment is vital.

How can you improve the overall customer experience across different channels?

What is customer experience in banking?

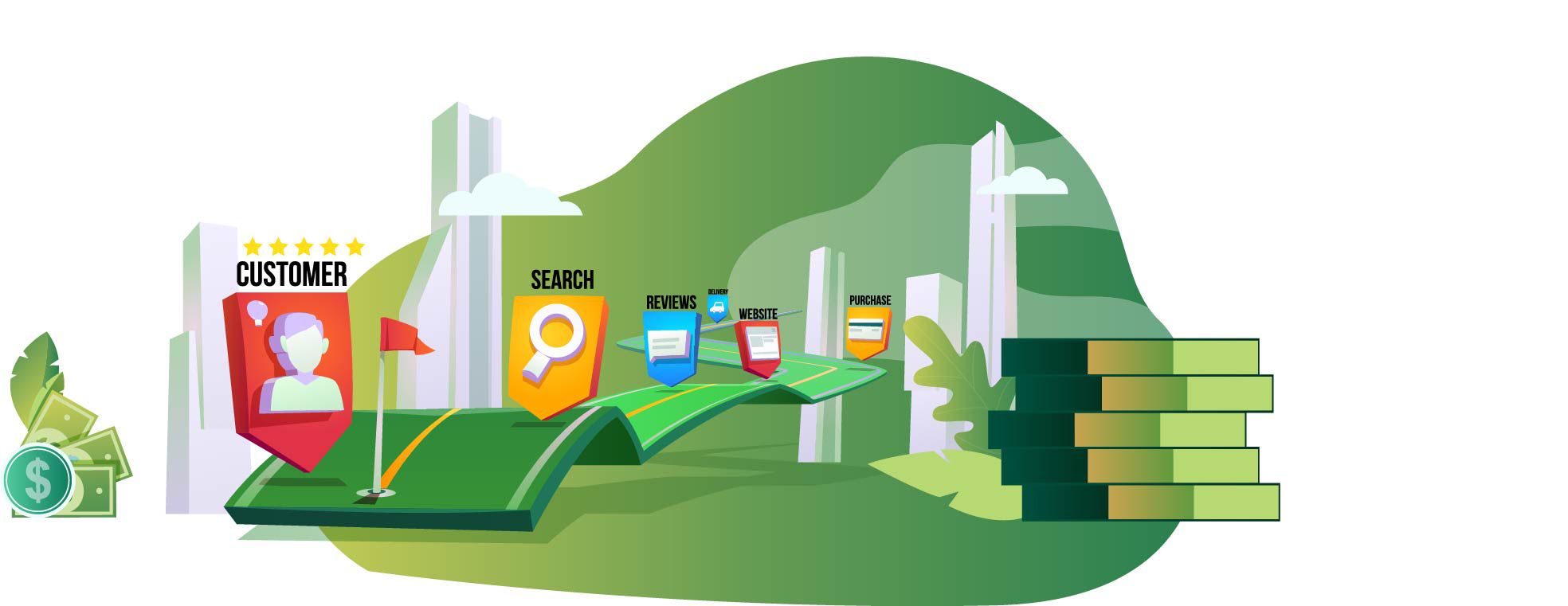

The customer experience in banking refers to all the interactions in various customer touchpoints. All customer interactions should be at the same quality of service across all channels, both online and offline. Banks should ensure that their digital channels are easy to use and offer a great customer experience. Customers should be able to easily find the information they need and be able to carry out transactions quickly and easily.

Ease of Use

Ease of Access

Instant and personalized support

Security and privacy

Real-time sync between physical stores and digital channels

What do customers want from a bank?

Omnichannel Customer Experience

Your most precious resource is your customers. Continuous innovation in the customer experience process is a vital element for banks to go beyond customer expectations. Sustainable success is all about putting customer experience excellence in first place.

Gaining insights into how you can improve the customer journey helps you to provide consistent and excellent customer service. Having an end-to-end roadmap of customer experiences allows you to determine your customer’s needs, motivations, and actions.

This will help you to create a more smooth and consistent customer experience.

Define Your Improvement Areas

Regularly staying in touch with your customers will help strengthen your relationship with them, and make them feel cared for. You can use survey feedback to create automated emails for your marketing or support team to contact customers.

A detailed understanding of your customer’s experience helps you to discover common customer complaints. Identify the digital touch-points customers have with your bank to know your customer expectations better. Defining the customer journey gives you a competitive advantage because it is vital for delivering a great customer experience.

CloudOffix offers a complete suite of tools which help companies to have a real 360-degree customer view.

Marketing Automation for Banks

Marketing automation is a hot topic for banks, credit unions, and mortgage firms. Therefore, implementing a marketing automation cloud to keep your competitive power. Marketing Automation platform helps banks to plan, implement and monitor their marketing campaigns. Marketing automation platforms help banks target their customers with the right messages at the right time.

Digital innovations have redefined the marketing strategies of retail banking. Innovations in workflow automation are always advancing. The digital transformation will go to greater heights since brick-and-mortar store banking began.

There are leading changes in consumer behavior and expectations to enhance customer experience. We value our time much more than before. No doubt that the banking sector is the best at collecting customer data. However more in-depth data helps you to achieve a better customer experience. Personalization is the key word to keep a longer term sustainable customer experience.

They have transactional, behavioral, and demographic consumer data more than in any other industry. This gives an incredible power to develop insight-driven marketing strategies. However, they struggle to optimize the data through marketing automation tools. A very small percentage of the banking industry uses this data to generate consumer insights and improve the customer experience journey.

Marketing automation software helps banks build a unique and long-lasting relationship with each customer. With the 360-degree customer view, banks gain insights to evaluate opportunities and increase customer experience.

A complete view of customers in real time allows you to manage data from multiple sources. This provides an improved customer experience and multiple channel sales opportunities.

Marketing departments consistently create leads from contacts, frequent website visitors, online live chats, or emails. They implement various methods for obtaining leads. However, the most crucial step is to keep up a live relation with those leads. The real goal is to nurture the leads and turn them into sales. The process of nurturing leads involves building relationships with leads, providing them with valuable content, and eventually selling to them. The first step in nurturing leads is to build relationships with them.

This can be done by providing valuable content that helps them solve their problems. Once a lead is interested in your content, you can then start to sell to them. The process of nurturing leads with marketing automation can be automated, which makes it easier to manage and scale.

Additionally, it can be customized to fit the needs of your customer.

In brief, marketing automation softwarefor banks makes it possible to obtain actionable insights. By analyzing customer behavior, banks can identify customer needs and design personalized products and services.